In today’s fast-paced financial landscape, having access to reliable and practical financial guidance is more important than ever. Wheon com has emerged as a trusted digital platform that simplifies complex financial concepts for everyday people. Whether you are a student just starting your financial journey, a working professional looking to grow your wealth, or an entrepreneur planning your next business venture, Wheon com finance tips offer actionable insights that can transform your financial future.

Understanding the Foundation of Financial Success

Financial success doesn’t happen by accident—it requires discipline, knowledge, and consistent effort. The first step toward achieving your money goals is understanding where you currently stand. Take time to assess your income, expenses, debts, and assets. This financial snapshot serves as your baseline, helping you identify areas that need immediate attention and opportunities for growth.

Creating a realistic budget forms the backbone of any solid financial plan. The popular 50/30/20 rule provides an excellent framework: allocate 50% of your income toward necessities like rent, utilities, and groceries; dedicate 30% to wants and lifestyle choices; and commit the remaining 20% to savings and debt repayment. This simple yet effective approach ensures that you maintain a healthy balance between meeting your current needs and securing your future.

Building Your Emergency Safety Net

Life is unpredictable, and financial emergencies can strike when you least expect them. One of the most critical Wheon com finance tips emphasizes the importance of establishing an emergency fund before pursuing any other financial goals. Aim to save at least three to six months’ worth of living expenses in a readily accessible savings account. This safety net provides peace of mind and prevents you from derailing your long-term financial plans when unexpected situations arise.

Start small if necessary—even saving ₹500 or ₹1,000 monthly can accumulate into a substantial cushion over time. The key is consistency. Automate your savings by setting up automatic transfers from your checking account to your emergency fund immediately after each payday. This “pay yourself first” mentality ensures that saving becomes a non-negotiable priority rather than an afterthought.

Tackling Debt Strategically

Debt can either be a powerful tool for building wealth or a destructive force that hinders your financial progress. High-interest debt, particularly credit card balances, should be addressed aggressively. Consider the avalanche method, where you focus on paying off the debt with the highest interest rate first while making minimum payments on other obligations. Alternatively, the snowball method prioritizes the smallest debts first to build momentum and motivation through quick wins.

When dealing with loans, always read the fine print and understand the terms completely. Wheon com regularly publishes comprehensive guides on personal loan applications, helping users navigate the borrowing process with confidence. Remember that not all debt is bad—strategic borrowing for education, home ownership, or business expansion can generate returns that far exceed the interest costs.

Investing for Long-Term Wealth Creation

Saving money is important, but investing is what truly builds lasting wealth. The power of compound interest works like magic over time, turning modest regular investments into substantial portfolios. For beginners, Systematic Investment Plans (SIPs) in mutual funds offer an excellent entry point into the world of investing. These plans allow you to invest fixed amounts regularly, benefiting from rupee cost averaging and eliminating the need to time the market.

Diversification is another cornerstone principle emphasized in Wheon com finance tips. Spread your investments across different asset classes—stocks, bonds, real estate, and gold—to reduce risk and optimize returns. Never put all your eggs in one basket, no matter how promising a particular opportunity may seem. A well-diversified portfolio can weather market volatility and deliver steady growth over the long term.

Smart Business Finance Strategies

For entrepreneurs and business owners, managing business finances requires specialized knowledge and careful planning. Separate your personal and business finances completely by maintaining distinct bank accounts and credit cards. This separation simplifies tax preparation, provides clearer financial visibility, and protects your personal assets from business liabilities.

Cash flow management often determines whether a business thrives or fails. Monitor your cash flow weekly, ensuring that you have sufficient liquidity to cover operational expenses, payroll, and unexpected costs. Consider maintaining a business emergency fund equivalent to at least three months of operating expenses. Wheon com offers valuable startup financial guidance, helping new business owners navigate the challenging early years with confidence.

Continuous Learning and Financial Education

The financial world evolves constantly, with new investment opportunities, tax regulations, and economic trends emerging regularly. Committing to continuous financial education keeps you ahead of the curve. Follow reputable financial news sources, attend workshops, read books on personal finance, and leverage online resources to expand your knowledge.

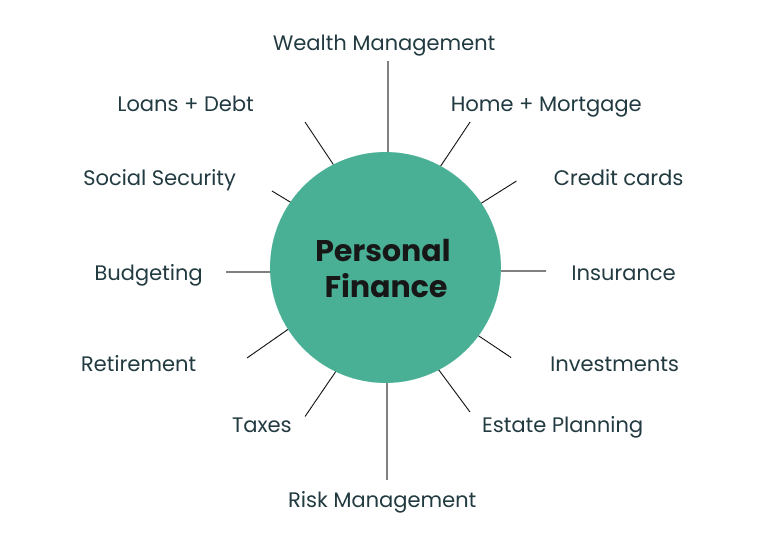

Wheon com serves as an excellent educational platform, offering simplified explanations of complex financial topics. Their content covers everything from basic budgeting principles to advanced investment strategies, making financial literacy accessible to everyone regardless of their background or experience level.

Conclusion

Achieving financial freedom is a journey that requires patience, persistence, and informed decision-making. By implementing these Wheon com finance tips, you can build a strong financial foundation, eliminate debt, grow your wealth through smart investing, and secure a prosperous future for yourself and your family. Remember that small, consistent actions today compound into significant results tomorrow. Start your financial transformation today, and let Wheon com be your trusted companion on this rewarding journey toward financial independence.